As an economist and all-around friend of strictly positive numbers I often use the log function. The natural logarithm of course, need I specify it? Apparently in certain spreadsheet software you do.

In this note I just wanted to write down a couple of observations about how to generate mean or median forecasts of a variable \(y\) given the model is fit in \(log(y)\). Of course, I am going to borrow heavily from Rob Hyndman’s blog, where he coverse this. But I also want to add in some code for a simulation from a seasonal arima model (also covered by Rob).

R code to follow

A simple ARIMA model

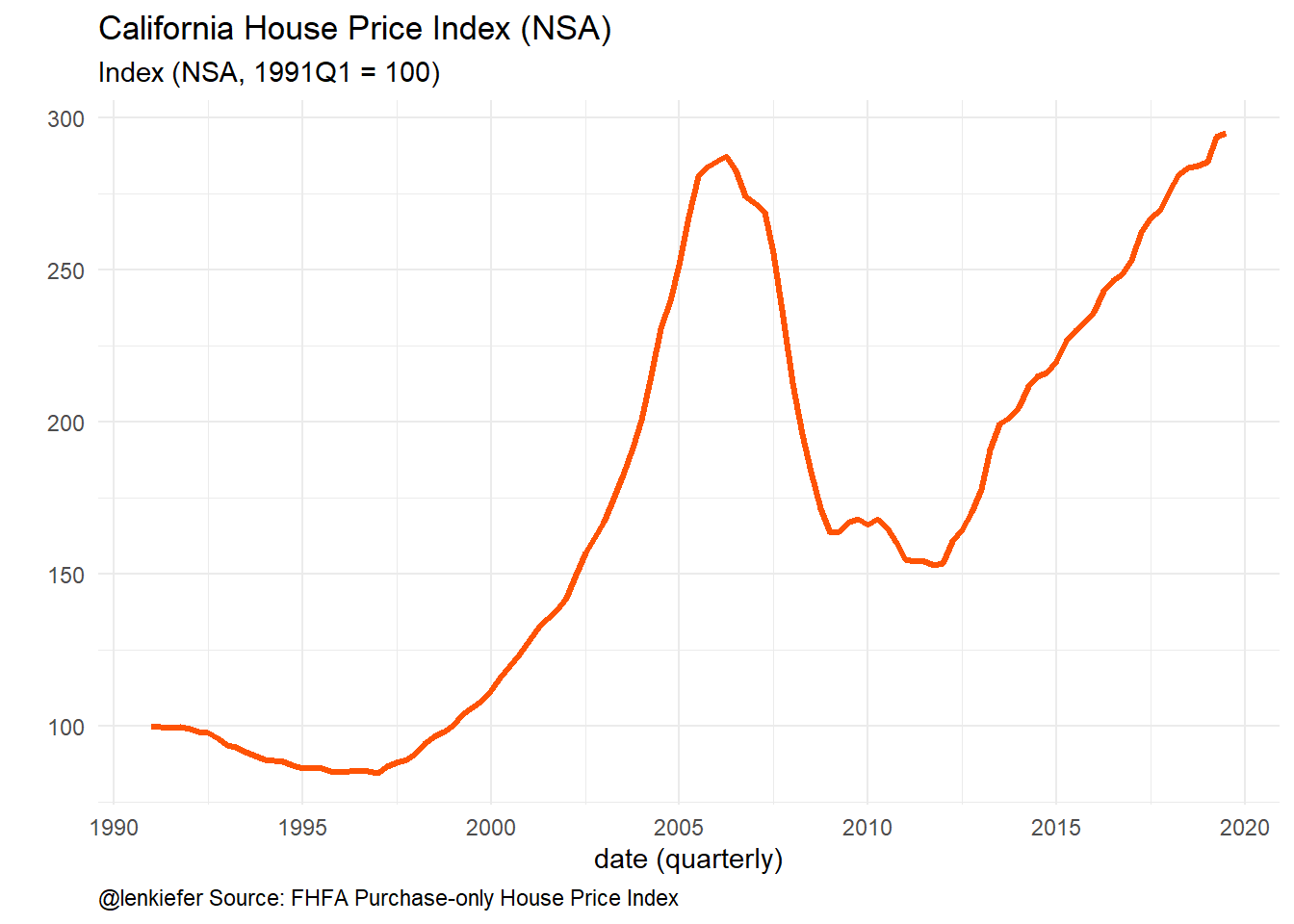

Let’s fit a seasonal ARIMA model with drift to quarterly house price index for the state of California from the FHFA. The FHFA provides a nice flat text file that we can read straight into our computer:

Set up libraries

library(data.table)

library(tidyverse)

library(forecast)

library(matrixStats)

# colors (http://lenkiefer.com/2019/09/23/theme-inari/)

inari <- "#fe5305"

inari1 <- "#e53a00"

inari2 <- "#a90000"Import data

# read in file

dt <- fread("https://www.fhfa.gov/DataTools/Downloads/Documents/HPI/HPI_PO_state.txt")

# construct a times series

ts1 <- ts(dt[state=="CA",]$index_nsa ,start=1991,frequency=4)

autoplot(ts1,color=inari,size=1.1)+

theme_minimal()+

theme(plot.caption=element_text(hjust=0))+

labs(x="date (quarterly)",y="",

title="California House Price Index (NSA)",

subtitle="Index (NSA, 1991Q1 = 100)",

caption="@lenkiefer Source: FHFA Purchase-only House Price Index")

Figure 1: House Price Index

Let’s fit a simple seasonal ARIMA model to this index using forecast::auto.arima. Note this isn’t necessarily a great model, or useful for anything. It’s just a pretty standard benchmark.

(fit <- auto.arima(ts1,lambda=0,allowdrift=TRUE))## Series: ts1

## ARIMA(2,1,1)(2,0,0)[4]

## Box Cox transformation: lambda= 0

##

## Coefficients:

## ar1 ar2 ma1 sar1 sar2

## 1.5855 -0.6934 -0.5263 0.3849 0.3375

## s.e. 0.1522 0.1272 0.1824 0.0958 0.0965

##

## sigma^2 estimated as 0.0001513: log likelihood=340.19

## AIC=-668.38 AICc=-667.59 BIC=-651.96fit1 <- Arima(ts1,model=fit)Construct foreasts:

# forecast horizon = 12 quarters

h <- 12

g1 <-

autoplot(forecast(fit1,h),color=inari,size=1.1,fcol=inari)+

theme_minimal()+

theme(plot.caption=element_text(hjust=0))+

labs(x="date (quarterly)",y="",

title="California House Price Index (NSA)",

subtitle="Index (NSA, 1991Q1 = 100)\nforecasts from ARIMA model",

caption="@lenkiefer Source: FHFA Purchase-only House Price Index")

g1

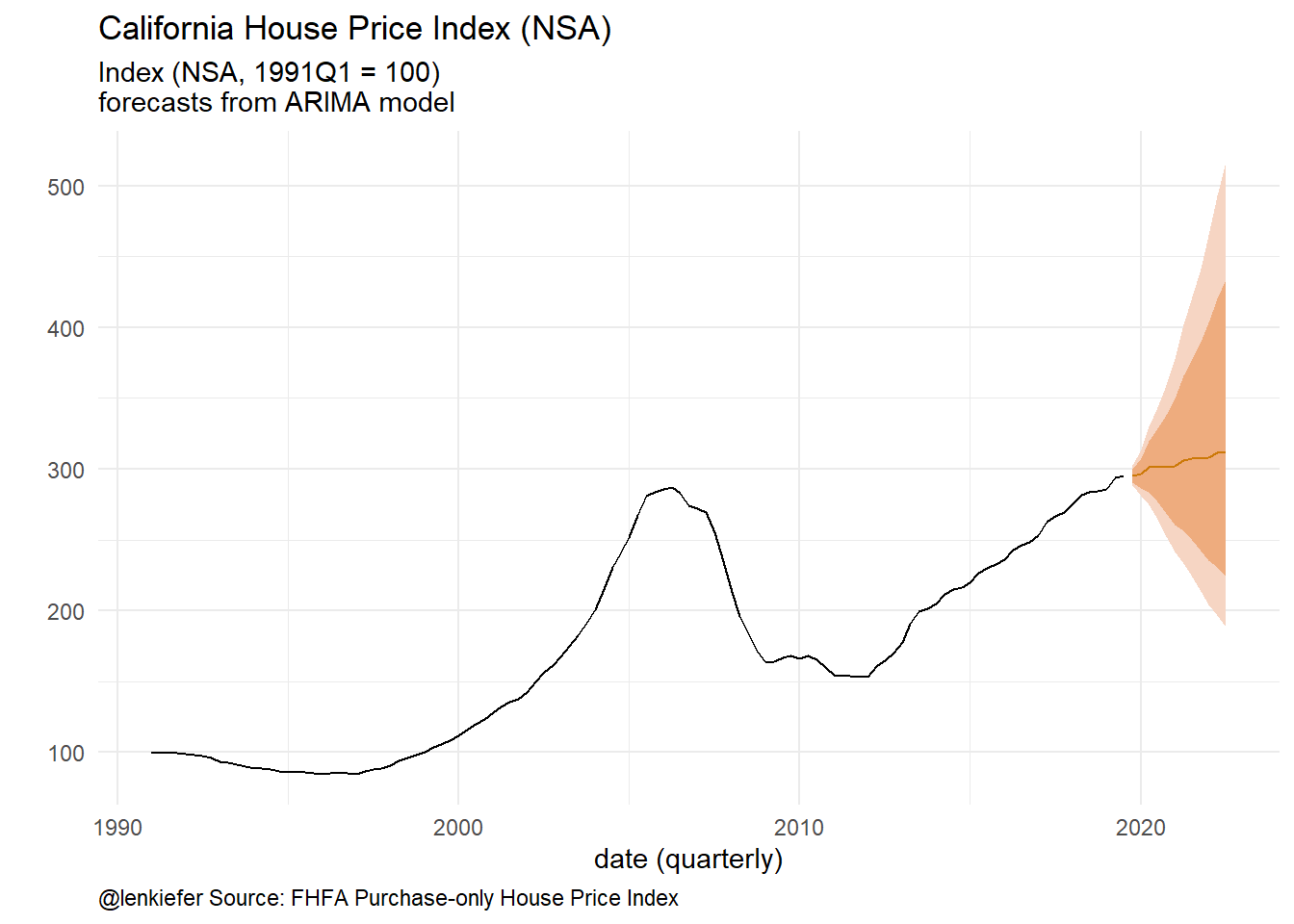

Figure 2: Forecasts from ARIMA

Note that the default parameter setting for forecast::forecast has biasadj=FALSE, which means the default forecast (the line in the plot above) is the median. If we want the mean forecast we can set biasadj=TRUE or just do it ourselves:

fc <- forecast(fit,h, level=95)

# as in https://robjhyndman.com/hyndsight/backtransforming/

fvar <- ((BoxCox(fc$upper,fit$lambda) -

BoxCox(fc$lower,fit$lambda))/qnorm(0.975)/2)^2

fc$mean_log <- fc$mean * (1+0.5*fvar)

colnames(fc$mean_log) <- "mean_log"

g1+autolayer(fc$mean_log, linetype=2,color=inari2)+scale_x_continuous(limits=c(2018,2022))+

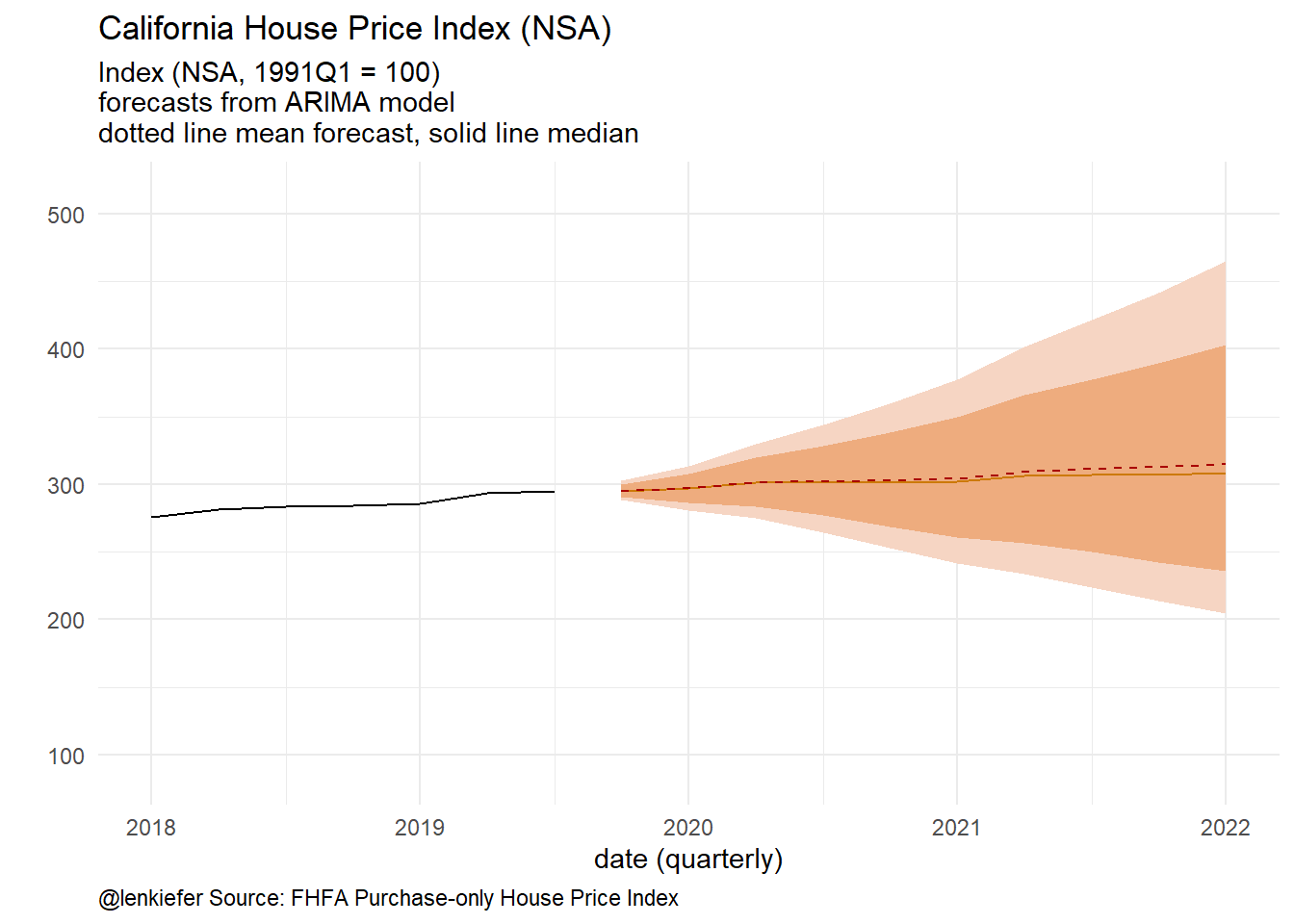

labs( subtitle="Index (NSA, 1991Q1 = 100)\nforecasts from ARIMA model\ndotted line mean forecast, solid line median")

Figure 3: Mean and median forecasts

A simulation

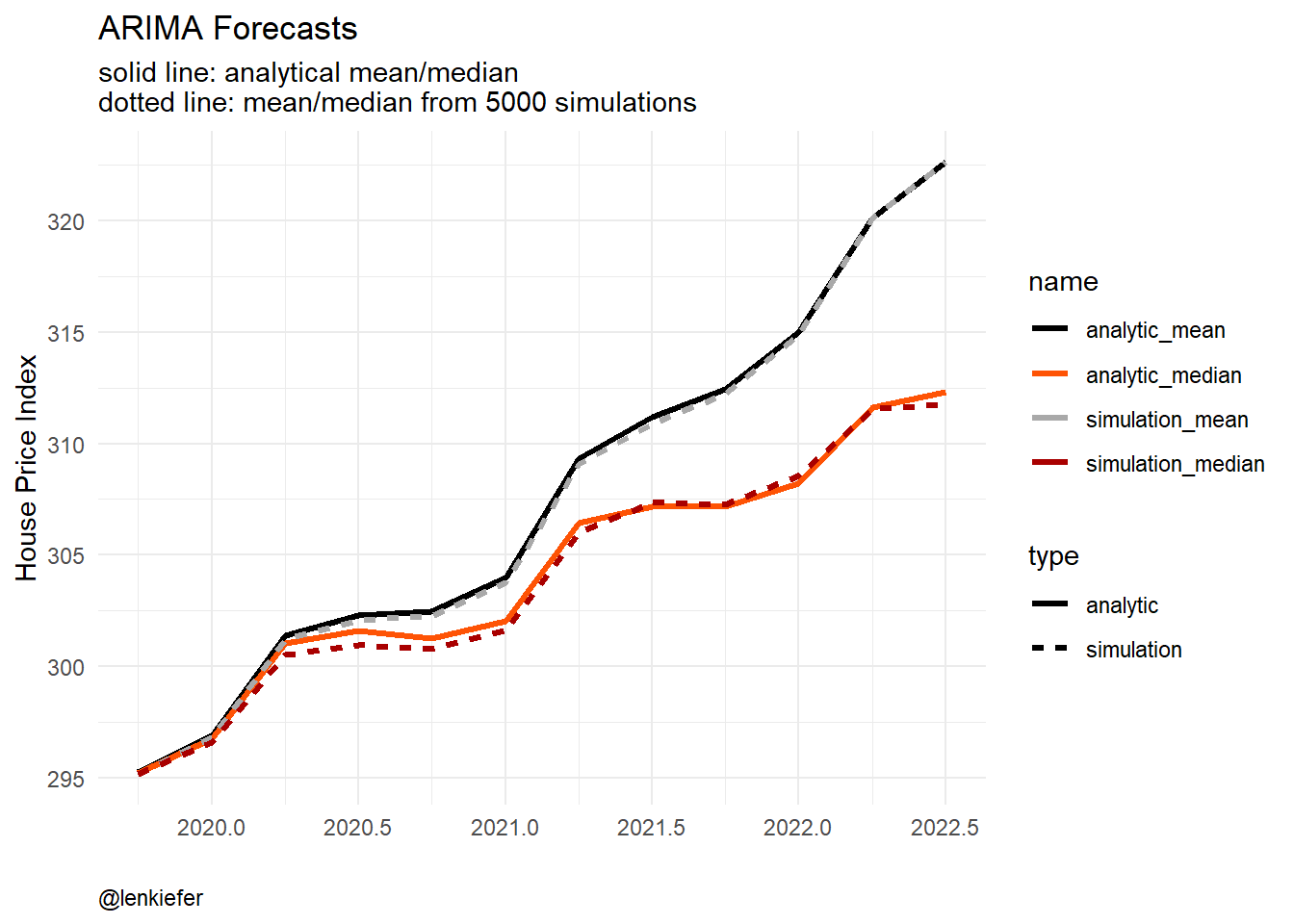

It’s always nice to check our results against a simulation.

# simulate from ARIMA https://robjhyndman.com/hyndsight/simulating-from-a-specified-seasonal-arima-model/

Nsim=5000

h <- 12

ts_sim=array(dim=c(Nsim,h))

for (i in 1:Nsim){

ts_sim[i,] <- simulate(fit1,nsim=h)

}

# create ts object

ts_sim <- ts(t(ts_sim),start=start(fc$mean),frequency=frequency(fc$mean))

colnames(ts_sim) <- paste0("sim_",1:Nsim)

# construct simulation means and medians

fc_median <- ts(rowMedians(ts_sim),start=start(fc$mean),frequency=frequency(fc$mean))

fc_mean <- ts(rowMeans(ts_sim),start=start(fc$mean),frequency=frequency(fc$mean))And make a plot:

# combine into data frame/tibble

df_plot <- tibble(tt=as.numeric(time(fc$mean)),

analytic_median=fc$mean,

simulation_median=fc_median,

simulation_mean=fc_mean,

analytic_mean=fc$mean_log[,1])

# make plot

df_plot %>%

pivot_longer(-tt) %>%

mutate(type=ifelse(grepl("sim",name),"simulation","analytic")) %>%

ggplot(aes(x=tt,y=value,color=name,linetype=type))+

geom_line(size=1.1)+

scale_color_manual(values=c("black",inari,"darkgray",inari2))+

theme_minimal()+

theme(plot.caption=element_text(hjust=0))+

labs(x="",y="House Price Index",

title="ARIMA Forecasts",

subtitle="solid line: analytical mean/median\ndotted line: mean/median from 5000 simulations",

caption="@lenkiefer")

Figure 4: Simulation Comparison

As time series go this is pretty straightforward stuff. I am just putting this down here so future me can reference this as needed.